Movement restrictions have changed the landscape of mass distribution: a boom in sales in certain categories, massive use of digital paths and proximity channels, etc. These changes in practices seem to be taking place well beyond the period of confinement.

FMCG brands must now take into account new consumer habits in order to build an effective marketing strategy over the coming months.

What are the new challenges for FMCG brands and retailers given this unprecedented crisis?

To help you prepare your marketing plan, discover our analysis of the immediate impacts of the epidemic on consumers’ shopping practices.

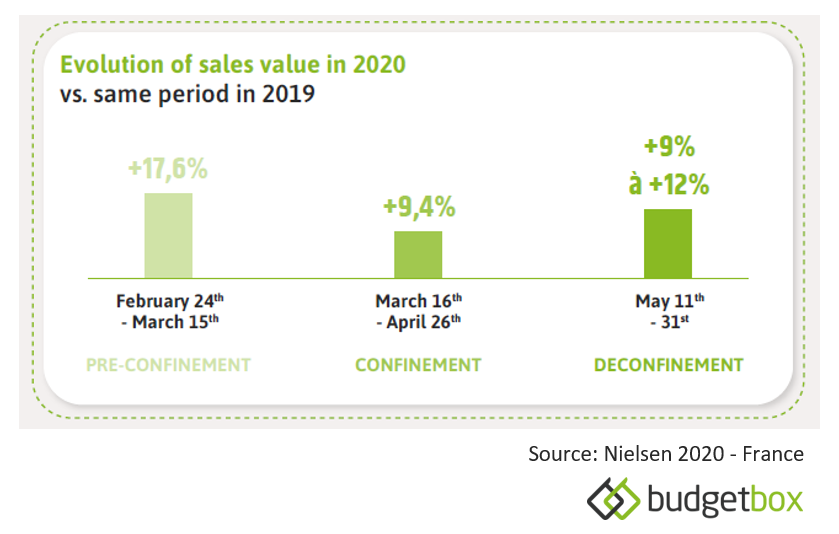

A BOOM OF RETAIL SALES THAT CONTINUES TO GROW IN FRANCE

Due to fears of shortages, consumers have bought and stocked products prior to the lockdown, especially basic necessities, creating a sales boom in certain product categories.

Nevertheless, following the implementation of confinement measures, the growth slowed down: a consequence of pre-confinement overstocking and movement restrictions.

But mass distribution nevertheless continued to see its sales increase throughout the confinement: once the stocks were emptied, French consumers had no choice but to go back to the shops to prepare all their meals. In this context, we observed a decrease in the frequency of purchases but an increase in the average shopping cart.

As of May 11th, the rules of confinement have been relaxed in France, but remote working remains privileged for activities that allow it and restaurants remained closed (except for take-away sales) until the beginning of June. Over the month of May, FMCG sales therefore continued to rise significantly.

Since the beginning of June, restaurants have been able to reopen their doors in the green areas and only their outdoor terraces in the red areas. The impact on FMCG sales remains unclear, but remote working, which is still the preferred option for part of the population, with meals taken at home, should maintain sales growth.

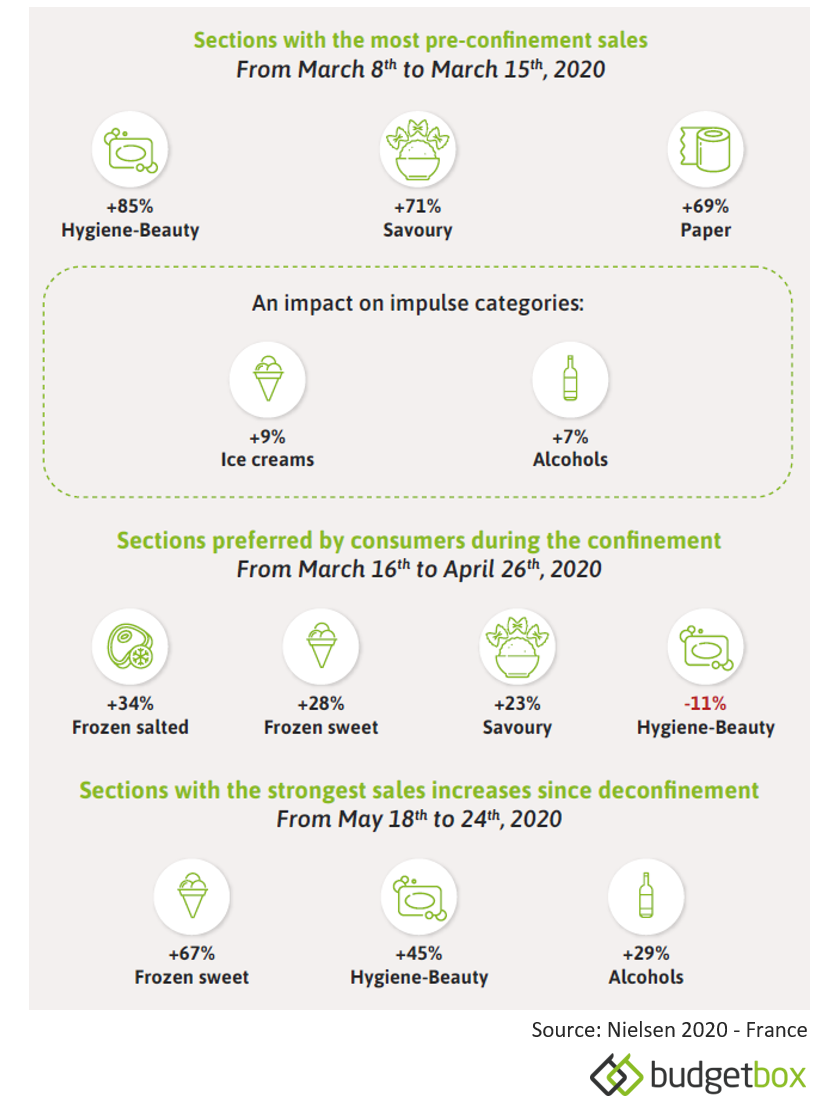

Which sections and products have been most influenced by this growth in France?

In the pre-confinement period, French consumers bought mainly products of primary necessity (pasta, rice, flour, soaps, toilet paper, etc.).

In addition to these everyday products, there was also a positive impact on sales of impulse categories such as alcohol and ice cream. With the closure of restaurants and bars, consumers seem to have anticipated a long-term lockdown, and also thought about “leisure shopping”.

During the lockdown, it is rather shelves with products with a long conservation date such as frozen foods (salty/sweet) or savoury groceries that have been favoured by consumers. Carmela Bazzarelli, Director of Category & Trade Marketing of the Barilla Group explains that the demand for pasta was multiplied by 10 over this period.

Find out how the Barilla Group increased its productivity by 30% to meet this high demand in this article.

After a drop during the lockdown (-15%), the Hygiene-Beauty section has gone back to green and has regained a good dynamic in the deconfinement phase.

The return to a social life and the reunion with relatives that have been allowed since May 11th, is beneficial without great surprise to “pleasure” purchases such as alcohol for example.

MUTATING SHOPPING PRACTICES IN FRANCE

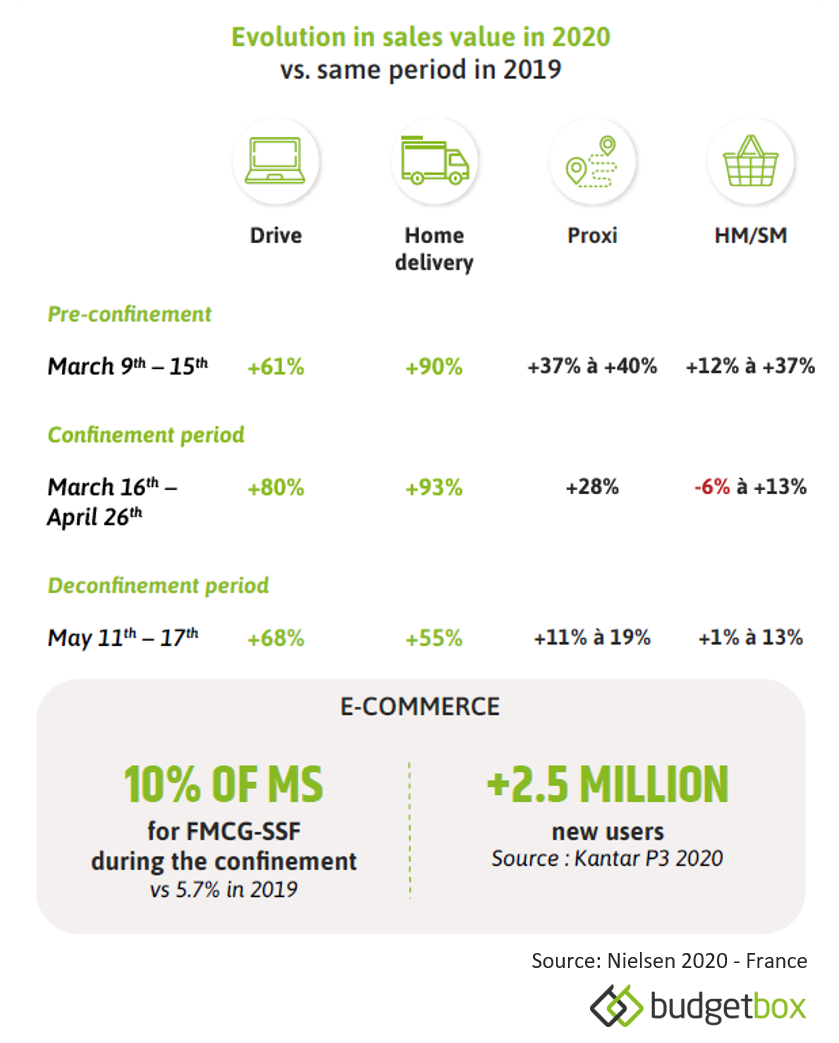

E-commerce is increasingly used for shopping

It was to be expected in such circumstances, drive and home delivery saw their sales increase from the beginning of March: in the week from March 2nd to March 8th, compared to the same period in 2019, this channel grew 4 times faster than the physical stores. And the confinement measures have not stopped this trend, quite the contrary!

According to Kantar, FMCG e-commerce attracted 2.5 million new French households during the lockdown.

These digital shopping purchase paths are starting to get established in the everyday routine: “Some consumers who did not use the internet for their everyday purchases have developed new habits during confinement, and will be permanently converted for a part of their purchases.”, according to Marc Lolivier, FEVAD’s General Delegate.

And this forecast is confirmed during the first weeks of deconfinement: although hypermarket and supermarket traffic is picking up slightly, e-commerce remains the preferred channel.

Among the food e-commerce channels, the big winner is undoubtedly home delivery. Although it remains well behind the drive, it has experienced phenomenal growth while this mode of shopping was rarely used for food products, mainly because of high delivery costs and long waiting times.

However, in times of epidemics, home delivery becomes an ideal solution for consumers who do not wish to go shopping and want to avoid crowds.

With the strong demand for digital shopping, retailers have faced new challenges: saturated e-commerce websites, longer delivery and driver pick-up times… They had to increase their efforts and ingenuity to satisfy consumers who are always looking for practicality and speed.

To meet this demand, partnerships with delivery start-ups such as Deliveroo, Uber Eats and Shopopop have been set up.

FMCG brands have also had to adapt to strong demand in certain categories and to changes in shopping practices. Find out more about the strategy and concrete best practices of Unilever and the Barilla Group to adapt to the retail transformation, now and in the longer term in this article.

Nielsen predicts that the e-commerce portion will stagnate at around 8% for the rest of this year. Thus 3 years of growth gained on the digital transformation of shopping according to our latest estimates.

In-store: proximity and digital in-store are privileged, HMs are struggling

Another phenomenon of the health crisis: the rise of the proxi. While sales on these channels had timidly increased at the beginning of March (+7% for rural proximity and +10% for urban proximity), they rocketed during the confinement period.

With movement restrictions in place and surcharged e-commerce websites, the proxi also seems to be an effective solution to shop quickly and comply with the measures in place.

Since mid-May, following the relaxing of movement restrictions, the growth of the proxi has been slightly lower than in the previous weeks, but this channel still remains dynamic.

On the contrary, hypermarkets and supermarkets have suffered from the crisis and social distancing measures. But since May 11th, the traffic in these supermarkets seems to be timidly returning.

As the epidemic is still present, Scan & Go seems to be an efficient solution to allow consumers to go back to shopping in HM/SM.

Scan & Go preferred

To respect social distancing and avoid queues, the use of scanners and smartphones for shopping is a solution: the consumer scans his products himself and benefits from a dedicated and faster check-out area, or pays directly in his application without going through the cashier.

At our partner retailers, the proportion of transactions with self-scanning doubled in March compared with last year.

This health crisis is leading consumers to rethink the way they shop in stores and experiment with new digital services.

According to our pre-crisis forecasts, the turnover of Scan & Go should represent 12 to 15% of the turnover of mass distribution in 2025. According to our latest estimates, this figure could be reached by 2021/22.

IN CONCLUSION

Long before the current health crisis, the shopping practices of today’s consumers were changing: 1 out of 5 French consumers said they did their shopping each week through a screen (drive, home delivery and Scan & Go – Harris Interactive & budgetbox 2018 study) and e-commerce represented 5.7% of FMCG sales value (Nielsen 2019).

With the confinement measures, there is a strong acceleration in the use of digital channels, with new users. During the first few weeks of deconfinement, these new practices remain rooted in their shopping habits.